Planning a new event can be fun and exciting. But how do you estimate the finances for something you have never done before? How do you respond when the committee chair asks the question you know is coming: “How much can we spend, and how much do we need to make?”

Depending on the PTO’s annual budget plan, your response might be: “Just break even.” Or you might say, “It doesn’t really matter how much you spend as long as you make $300 net profit.” Or “Cover your costs with ticket and food sales, plus the PTO will spend another $200.”

You then might feel that you have answered the questions, but does that information really help the chairperson? There is a way you can create a tool that will help keep the event on budget, give you some peace of mind, and collect data that will be extremely helpful in the future.

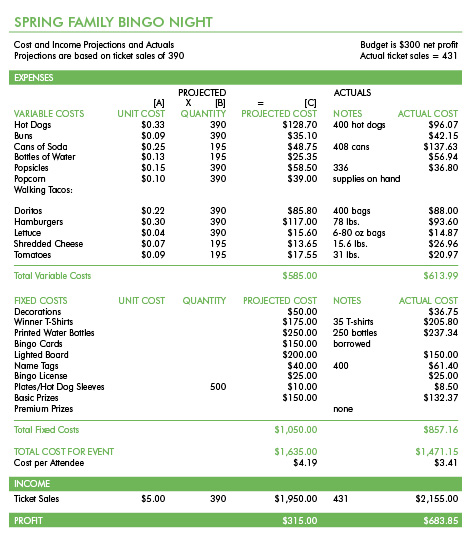

Spring Family Night

Last year our PTO board proposed to revamp the annual spring family night. It was time to try something new, but we wanted to leave most of the detail planning to the committee.

So when we established the PTO’s budget early in the year, we had no idea what form the new event would eventually take. Our decision was to set a fairly conservative target of $300 in profit, based on results from the traditional spring dance that we were replacing.

A couple of months later, the committee announced plans for a family bingo night. As expected, one of the first questions asked by Terri, the committee chair, was, “How much can I spend, and how much do we need to make?” I reminded her that the budget was $300 in profit, but I did not have a good answer for how much she could spend. “Of course,” I said, “that depends on how much you expect the event will bring in.” You might wonder what that was supposed to mean. Fortunately, Terri appreciates the value of a good plan, and as soon as her committee started to formulate theirs, Terri started to build the Bingo Night cost model, which gave us all the information we needed.

The Model

The cost model is a simple spreadsheet that tracks projected and, later, actual costs and income for an event or project. A cost model can be built for any event that generates costs, but the technique is particularly useful for any large, complex event that could put the PTO at financial risk.

The treasurer can help the committee stay on target by providing the basic structure of a cost model. The committee chair or another numbers-oriented member of the committee should keep updating the spreadsheet as plans firm up, eventually developing an accurate history of the costs and income for the event.

Along the way, the cost model will allow the committee to see financial problems before they become crises. The committee will have time to adjust its plans, if necessary, rather than coming to the board with difficult or embarrassing financial news.

You can create the spreadsheet on paper, but a computer-based spreadsheet tool such as Microsoft Excel will make the job vastly easier. (You can also make this and other tasks easier by using PTO Today Finance Manager, easy-to-use web-based software for managing and organizing your group's finances.) Electronic spreadsheets can also be emailed among committee members and the officers. An example of our Bingo Night cost model is shown here (Spring Family Bingo Night, below); you can also download a blank family event cost model spreadsheet from the File Exchange.

Building a Cost Model

When you begin to build a cost model, start with your best guess of the costs and income for your event. The committee had several meetings at which they brainstormed ideas for Bingo Night. What kind of food should we serve? Should we sell dinner tickets or charge a la carte? How many people do we project will come? Should we have other activities besides bingo and dinner? Where will we get the bingo supplies? The basic questions and early decisions formed the basis for the cost model.

The first draft of the Bingo Night cost model had just a few lines of information: projected ticket sales, hot dog cost, taco cost, decorations, and bingo supplies. Even in a simple cost model, it is important to notice that some costs are variable and some are fixed.

In our case, the variable costs were influenced by the number of attendees we predicted. Specifically, food cost depended on attendance, because we would only buy enough food for the number of tickets sold in advance. On the other hand, the costs for decorations and bingo supplies were fixed because these costs were not influenced by another factor. For example, we expected to spend $50 on decorations no matter how many people bought tickets.

The spreadsheet includes fixed costs as estimated by the committee. For variable costs, we multiplied the unit cost (in this case dollars per person for specific food items) by the key factor (number of tickets sold). For example, cost for hot dogs was 33 cents apiece. We expected to sell 390, so the projected cost for hot dogs was $128.70.

We decided to give people a choice between soda and bottled water. We projected that half would drink soda. At 25 cents per can times 195–half the expected attendance–that’s $48.75. Water we could get more cheaply, 13 cents a bottle. Times 195, that equals $25.35. Total beverage cost, $48.75 plus $25.35, was projected at $74.10.

Even in the early versions of the cost model, the committee chair was sensitive to the goal of $300 in profit. She added a line for income (projected number of tickets sold times price per ticket) and compared the total projected costs to the projected income. Terri knew that as long as the projected profit was at least $300, her committee was staying on target financially.

If you build your cost model in an electronic spreadsheet as Terri did, you can try some “What if” scenarios to help the committee make decisions:

What if we only sell 250 tickets? Can we still afford the printed water bottles we plan to give as prizes?

What if we can’t borrow the bingo cards and have to buy them ourselves? How much more will we have to charge for tickets to stay on budget?

Over the next several weeks, the committee finalized plans, ticket sales commenced, and the supplies were purchased. All these changes were updated in the cost model. Terri added more cost lines and inserted better information and details as they became available. For example, the food chairperson obtained specific costs for the hot dogs, buns, popcorn, taco meat, lettuce, and other items. Even though she had not yet purchased the food, the model could give her an idea of the total expected cost for the food, based on the number of tickets sold thus far. At this point in the planning, the cost model was changing almost daily.

Several times during those weeks, I received reimbursement requests from committee members. I quickly relayed this information back to Terri so she could update a new column called Actual Costs.

It was very interesting to see how accurate, or not, the best guesses were in comparison to the actual expenses incurred. In most cases, the more “mathematical” the projection, the more accurate the figure was in the long run. In other words, when you prepare a cost model, try to base your projections on valid assumptions and sound calculations, and guess only when absolutely necessary.

The Outcome

With this information, Terri and the committee were able to make better decisions and adjust as necessary. When ticket sales seemed to dip below projections, the committee decided to skip the premium prizes they had hoped to order. If the committee had simply gone ahead and spent the money without considering the cost model, the expense might have been enough to drop the event below its profit goal.

In the final analysis, the event came in significantly ahead of budget, but why? By reviewing the cost model, Terri could see that the actual variable costs were just about on target. We were able to borrow bingo cards from another school, which saved us $150, and the lighted bingo board cost less than projected. Plus, a late rush in ticket sales put the event over the top. The cost model provided this insight, which helped the committee make recommendations for next year.

Not every volunteer feels comfortable working with a cost model. But if the treasurer can provide the template and a little helpful assistance, this tool can collect valuable information. The committee can stay on track, raise the red flag early, if needed, and present to the board and the members proof that they were fiscally responsible in planning the event. That sounds like a lot to owe to a one-page spreadsheet, but try it to see whether you don’t agree.