How much money will your PTO have in the bank on the first day of school? Will you carry over just the bare minimum specified in your bylaws? Will there be a comfortable cushion for starting the year so you won’t have to begin the year with a fundraiser?

Will your PTO set aside a large sum that is earmarked for a special project, such as playground equipment? Or will you carry over thousands of unallocated surplus dollars?

As treasurer, you possess the information needed to advise your fellow officers early each spring of the parent group’s financial position for the next few months and on into the next school year. You can analyze this early enough that decisions can be made and votes can be taken to adjust spending so you can avoid big surprises come June.

If your group is like most, you adjust when a fundraiser falls short. If a fundraiser comes in under budget, officers are motivated to act quickly because no one wants to commit to a bill the PTO cannot pay. If you are in that unfortunate situation, your group probably has already made difficult decisions about cutting programs or activities.

But PTOs don’t always react this way when fundraisers earn more than expected. If your fundraisers have earn more than planned, hopefully your parent group has already voted to spend some of the surplus on new projects. For example, one December our principal asked our PTO for $1,000 toward a special learning event the following spring. At that time, we knew we had cleared about $5,000 more than expected on our fundraiser. The PTO approved the principal’s request at our monthly meeting, and the treasurer noted that our available surplus was now $4,000.

Why You Should Know Your Financial Position

By springtime, your PTO has probably done at least one major fundraiser and perhaps one or more minor fundraisers. A budget surplus can build up when your fundraisers perform better than planned. Even if one fundraiser fell short, others may have earned enough to make up for the shortfall.

Your PTO also has funded several projects and purchased items for students, staff members, and the school. Individual committees may have completed their projects without spending their entire budgets. For example, the popcorn committee bought all the supplies it needed last fall and spent only $45 of the $100 budgeted. That leaves $55 unspent and available for other projects. Over the course of the school year, a little here and a little there can add up to a sizable budget surplus.

This comfort could lead to complacency: The PTO knows it has plenty of money to cover its plans this year, so let’s leave well enough alone. We might need that “extra” money next year.

Some PTOs do not do a detailed analysis of their position because they know they have at least enough money to cover their planned expenses. Over several years, a PTO using this management style can build up thousands of dollars of unallocated money yet still continue fundraising each year.

If your group is lucky enough to raise more money than you spend, you should have a plan for that extra money. Putting it in the bank is fine, but if you already have a large surplus and add a significant amount to it every year, it might be time to rethink your strategy—or perhaps to develop one. Consider adding an extra enrichment or parent involvement event for the end of the year or for next year. Or perhaps you could step down your fundraising efforts. The point is to make an active decision.

It’s important to carry over some money, and it’s common for parent group bylaws to require a specific carryover amount. With money in the bank at the beginning of the year, you can start with an event to build parent involvement or an activity for the first day of school. With no carryover, you’d be forced to start with a fundraiser, and that’s not a good way to build interest and excitement in the PTO.

Simple Budget Calculations

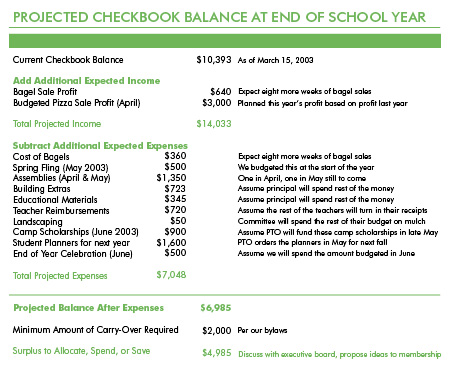

The easiest way to forecast your PTO’s year-end financial position is simply to do the math. This exercise will give you a fairly good idea of your checkbook balance: Start with your current checkbook balance, then add any guaranteed future income and subtract remaining expenses. Try this analysis for the first time in March—any earlier and there may be too much activity remaining to do a meaningful forecast.

Update the analysis every couple of weeks, and by late April you should be able to advise the executive board on the amount of projected surplus (or shortfall) for your PTO. This gives your PTO members the month of May to decide how to spend any surplus, make a conscious decision to save the money for next year, or allocate it toward a special project.

Even if your group votes to save the entire surplus, at least it is an informed decision that involves your members, not just you as treasurer. Our PTO was lucky enough to have a surplus of $3,000, which we voted to save for new playground equipment. We did not have enough money to pay for the whole project at that time, but our members agreed to set aside this surplus as seed money for the new playground rather than carry it over into next year’s budget.

Running the Numbers

Here’s how to set up the analysis described above:

-

Start with your current checkbook balance.

-

Add any known future income. In our case, we earn about $80 per week on bagel sales, so I add $80 multiplied by the number of weeks left in the school year.

-

If you have any future fundraisers scheduled, add the estimated profit. (See the “Projected Checkbook Balance at End of School Year” chart below.) This new total is your projected income.

-

Now deduct future expenses from your projected income. First, subtract any known regular expenses that remain. For example, we spend about $45 per week on bagels, so I subtract $45 multiplied by the number of weeks left.

-

Next, subtract any budgeted amounts for projects that have not yet started or are still in process. (At this point, you should not presume that a project in process will have any budgeted money left. To be safe, assume the total budget will be spent.) For example, by March we will have spent a portion of our assemblies budget but not all of it. I assume that the rest of our budget will be spent on the scheduled assemblies in April and May. So I subtract the rest of the assemblies budget from my checkbook balance. Also, our school safety patrol has its party at the end of the year, so I assume that the PTO will spend $250 in June, as budgeted. I subtract $250 from our checkbook balance.

-

Finally, consider any other anticipated projects or activities that are not already in your budget and subtract their cost from your checkbook balance. For example, our principal asks the PTO to contribute to the spring art fair because the school unexpectedly needs to rent display stands. This was not a planned expense for the PTO, but we anticipate approving the request this spring. I subtract $250 from our checkbook balance.

Give it your best guess. You have been treasurer for many months now and probably have a good idea of the expenses that remain this school year. You also can look over the treasurer reports and checkbook registers from prior years for more insight into the types of expenses ahead.

This analysis is not a precise science. Unexpected variables can affect your PTO’s exact financial position come June. But if you apply a little of your knowledge of the PTO, basic math, and some common sense, you will provide your members with valuable information about their money. And isn’t that one of your most important responsibilities as treasurer?

Originally posted in 2003 and updated regularly.