It’s not so much that it’s hard to be a PTO treasurer. The responsibilities are structured and procedural, which makes learning the job fairly straightforward. The tasks don’t change much year to year, so if you’re transitioning from a well-organized predecessor, you’re in great shape. Even if you’re inheriting a heap of financial gobbledygook, you can get control and keep your sanity all year long.

But the job does require attention to detail, good organization, and an affinity for numbers. The key is to understand the fundamentals and have a general idea of what to expect down the road. Here are some tips that will help you get started and stay on top of things throughout the year.

Be Prepared

Dive in even before school starts. If you’re new to the job, meet with the former treasurer at least once over the summer. Listen to her advice, have her walk you through her files, take notes, and follow up with questions.

Spend a little time with your predecessor to learn the PTO’s computerized accounting system. If it’s web-based like PTO Today’s Finance Manager, transition is simply a matter of changing the access password. If the system resides only on her home computer, you’ll need to work together to transfer the system to your own computer.

Change the signature cards at the bank so the new officers are authorized to sign checks. Review your current bank account fees; if they’re high, it might be time to change banks.

Set up a filing system at your house. A file drawer or file box and a three-ring binder with dividers might be all that’s necessary to keep things in order, but it helps to have an electronic filing system set up, too.

Be a Resource

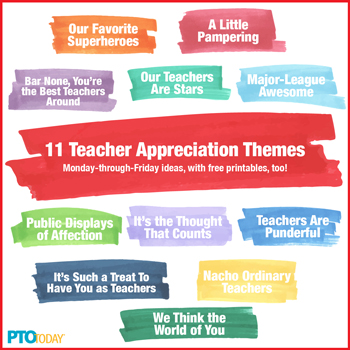

The most important duty of a treasurer is to be a good custodian of the PTO’s money. That’s probably obvious even to brand-new treasurers. But there is a second treasurer duty that’s almost as important as the first: You must provide financial information to support decisionmaking. The treasurer is the one who truly understands where things stand financially. She is the one who can (and should) say “We can’t afford that model of popcorn popper” or “We have this much budgeted for staff appreciation” or “We’re able to cancel our spring fundraiser because the fall festival was so successful.”

While the treasurer has the financial answers, she does not make decisions in a vacuum. The money is not yours exclusively. You must work as part of the parent group team and within the limitations of the group’s budget.

Be open and approachable about the financial information. Don’t get defensive if members ask questions about finances—for one thing, you might be speaking to a future parent group treasurer. Your knowledge of the PTO’s financial picture is essential to helping the whole group meet its goals this year.

Be Tough

More than most PTO jobs, the treasurer depends on procedures and policies. Your life as a PTO treasurer will be far easier if you establish good habits from the start.

Adhere to a set of financial control policies. Don’t stray from them, no matter what. If your policy dictates that every check should have two authorized signatures, don’t bend the rules because the president is out of town. If a member tackles you at the grocery store, expecting you to take the wad of receipts she’s thrusting at you, gently push her hand back and remind her she can get a reimbursement request form in the school office. If your movie night chairperson wants to rent the local theater instead of using the gym, firmly remind her of her committee’s limited budget. And when the carnival chairwoman plunks down a gallon-size plastic bag of ticket proceeds, hand her a deposit notice and ask her to count the money before turning it in.

If you consistently apply the financial policies, you will reduce the risk of mismanagement, error, and confusion. You might raise a few eyebrows the first time you refuse to let the president sign a few blank checks “just in case,” but you are doing your job. And don’t worry about offending your friends and fellow PTO leaders with your strict rules. If you’re consistent, everyone will learn the procedures and come to appreciate your professionalism. Over time, the rules will become a natural part of the way your group operates.

Be Ready To Learn

Start with the basics. Read your PTO’s bylaws and your treasurer’s manual. Review last year’s budget and monthly treasurer’s reports. Scour the transaction log and read the audit report. Use the information to build a foundation of knowledge about your PTO’s financial situation.

Understand how your PTO is set up. Are you a committee of the school, an informal but independent organization, or a full-fledged, federally registered 501(c)(3) tax-exempt charity? Does your PTO have its own tax identification number? Is your PTO incorporated in your state? Is your group bonded? Do you have your own liability insurance?

No matter how big or small, the independent PTO is a business in the eyes of the IRS. Don’t be intimidated by the IRS; the agents are genuinely helpful. Understand how your group is organized, and you will know your PTO’s relationship with and responsibility to the IRS.

For a full rundown of treasurer duties over the course of the year, review the PTO Treasurer’s Planning Checklist.

Begin With the End in Mind

Someday you will complete your role as PTO treasurer. At that time, you will transition the job to a new volunteer, one who may feel as unprepared and overwhelmed as perhaps you once did. Take steps beginning today and continuing throughout the year to make her transition and training easy.

-

Develop or update the treasurer’s procedure manual for your PTO.

-

Document financial control policies. Record them in the minutes of a meeting, and attach them as a formal component of your bylaws.

-

Develop a comprehensive budget for the year. Adopt it at an early meeting and use it to guide your group’s financial activity.

-

If the historical financial recordkeeping consists of a mess of paperwork in an old box, spend a little PTO money on a real file box and dividers. Set up a filing system for this coming year and stay organized from the start.

Make it your mission to leave the treasurer’s “office” in better shape than when you arrived. By keeping an eye on quality all year long, you’ll serve your group well this year and into the future. Heck, you might even like the job enough to run for reelection.

9 Things You Need To Know

-

Your PTO’s tax ID number, formally called the Employer Identification Number (EIN).

-

Your group’s bank account number. Some groups use the school’s tax ID number, which is not recommended. Worse yet, some open their account under a member’s personal social security number, which can create significant tax issues. The best approach is to get the PTO its own EIN from the IRS and open the bank account under that number.

-

The end of your PTO’s fiscal year. This is a key date for keeping financial records.

-

The meaning of “501(c)(3).” That’s the section of the federal tax code under which certain organizations, including parent groups, can earn tax-exempt status.

-

Whether your PTO is a registered 501(c)(3) organization. If you’re not sure, call the IRS. If your group is registered, you should have a “determination letter” from the IRS in your files, which declares your PTO a tax-exempt charity.

-

Whether your PTO is incorporated in your state. Typically, incorporation is renewed annually. You should see evidence in your files that your group has been submitting the renewals.

-

How sales tax exemption is determined in your state. Rules vary from state to state. Check with your state’s treasury or commerce department or on the state website for specifics.

-

The telephone number of the IRS: 877-829-5500. Despite their reputation, IRS representatives can be quite helpful.

-

The location of past 990/990EZ forms, the annual tax return required by the IRS for 501(c)(3) organizations. If your PTO is a 501(c)(3) group, you should have copies of past 990s on file. If you can’t find any in your files and you’re certain your PTO has 501(c)(3) status, it’s a good idea to call the IRS to find out whether your PTO has been negligent in filing the form.

Originally posted in 2007 and updated regularly.