How To Manage Your Budget

These basic bookkeeping procedures will help you keep your PTO budget in order.

PTO committee chair to treasurer: "I want to have the spring staff appreciation luncheon catered next month. I think it will cost about $300 extra, but the teachers are worth it."

Treasurer: "That's a nice idea, but I don't know if we have the money to pay for it. Your budget is only $200, and that's assuming all the food is donated."

Committee chair: "What's the matter? Don't you want us to put on a nice event? Do you think I have time to make all the food? There must be extra money—we always pay for extra things. And besides, I already told the principal, and she likes the idea."

Treasurer: "I'm not trying to be difficult. It's just that I'm afraid if we take $300 out of the bank to pay for this, we won't have enough money to pay for other things we've planned."

Committee chair: "Like what?"

Knowing the Answers

Have you ever found yourself in a similar situation? Have you ever felt pressured to keep everyone happy—to say yes to everyone? You're the treasurer; you're supposed to know everything about the money, right? Your members expect you to approve spending requests right and left: in the parking lot, in the lobby, at the grocery store, just before your meeting. Surely you, of all people, can decide whether your PTO has enough money. And you better not say no!

Would your life as a parent group treasurer be easier if you really knew whether you had enough money? Well, you can know, simply by managing the activity of your group against the budget categories you set up at the start of the year. Think back to August when you figured all the ways your group earns and spends money. If you set up an annual PTO budget, then you probably defined a list of income categories and expense categories. You may have logged the categories in a ledger book or set them up in an electronic money management system. Either way, setting up the list is only the beginning. To get the maximum benefit from your budget, you must manage it, too.

Each month, you write checks and make deposits on behalf of the PTO and record the transactions in the check register. The next step is to record each transaction against one (or more) of your budget categories. Checks represent expenses, so they get posted against expense categories. Deposits represent income, so they are posted against income categories.

If you know how much you planned to earn or spend (your budget) and can compare that to how much you actually have earned or spent (your actual year-to-date), then you can easily answer detailed questions confidently and without your personal feelings coming into play.

Join the PTO Today community (it's free) for access to resources, giveaways and more

Consider this alternate to the conversation above:

PTO committee chair to treasurer: "I want to have the spring staff appreciation luncheon catered next month. I think it will cost about $300 extra, but the teachers are worth it."

Treasurer: "That's a nice idea, and I know your budget is only $200. The latest treasurer's report shows that we exceeded our candy fundraiser goal by $150. I also see that we exceeded our shoppers loyalty card income budget by $150. That's $300 in surplus. Why don't you make a motion at our next meeting to reallocate the extra money to staff appreciation?"

Committee chair: "Thanks. That's a great idea. Could you write it down for me?"

Budget Basics

It takes some planning, and some time each month to track all your financial activity at the category level, but there are specific benefits to keeping on top of your group's finances. You now have the information you need to monitor surplus income throughout the year, so you can propose ways to spend the extra money. On the other hand, you can tell early on whether your PTO might need to cut some budgets if your fundraisers fall short.

If you view your finances only as a total, come June or July when all of the outstanding PTO bills have been paid you might find that your checkbook is holding thousands of dollars that you can't spend. Worse yet, you might not know you have an income shortfall until your checking account balance is too low to pay for an event you have planned.

If your PTO runs tight financially in the spring and you consistently cannot fulfill your financial plans for events late in the school year, you will benefit from managing your budget more closely month to month. If your PTO consistently finishes the year with several thousand dollars in the bank above and beyond what your bylaws require, you also could benefit from managing your budget better. After all, you raise money to help the students, not the bank.

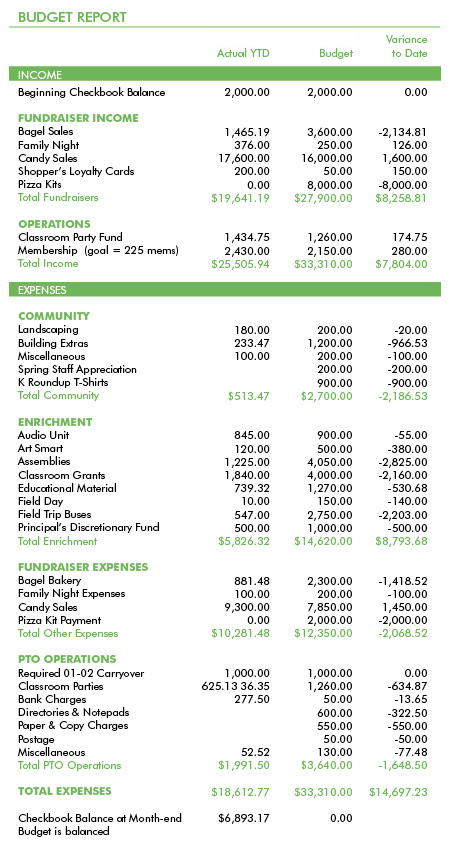

The budget report lists activity through the month of December. The membership entry under operations income shows that the PTO budgeted $2,150 for dues income. The membership drive finished in October, actually taking in $2,430 in dues (actual year-to-date). This represents $280 more than planned (look at the Variance column). Since the overall budget was balanced when it was set up in August, the $280 is unplanned income. It is surplus money that can be spent on an unfunded activity or kept for emergencies.

Your budget can be used to avoid potential problems. Look at the first entry under expenses: Landscaping. As of Dec. 31, the committee already has spent $180 of its $200 budget. With this knowledge, you as treasurer can advise the landscaping committee that it has very little money to spend on spring flowers. The committee members have plenty of time to decide what to do. Maybe they should try to solicit flower donations. Maybe they want to request an increase in their budget if there is surplus fundraising money or if another committee will not need its entire budget.

A budget reallocation request should be proposed, discussed, and voted at a PTO meeting so the members—not you—can decide the best course of action. Of course, there's plenty of money in the PTO's checkbook to buy a few flats of impatiens. But that money has already been allocated to other activities as shown on your budget. Whether or not you personally like flowers, you can objectively provide specific information for the committee so it can plan accordingly.

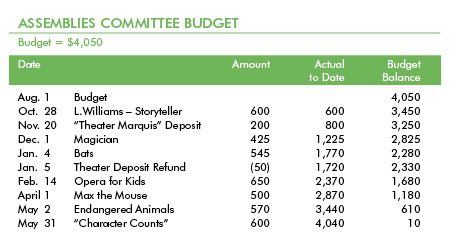

Tracking activity at the category level also creates a powerful history for your PTO. With this information, you can give a committee chair a detailed report showing exactly how her project's budget has been spent, check by check. This history also helps you budget for next year and allows you to answer questions about PTO activity. It can even come in handy when you complete the application for 501(c)(3) status, the official nonprofit designation from the IRS. Detailed tracking can be done manually in a ledger book, as shown here, or through a software program such as Quicken, Microsoft Money, or PTO Today Finance Manager.

Knowing where your PTO stands financially gives you the ability to answer questions accurately, with confidence, and without emotions coming into play. You keep on top of your PTO's situation so you can be proactive rather than simply reacting as issues come up. And you create a legacy of information that benefits your PTO in the future. At first, it might seem like a lot of tedious work to record every transaction against a category, but before long, you will realize the power of information.