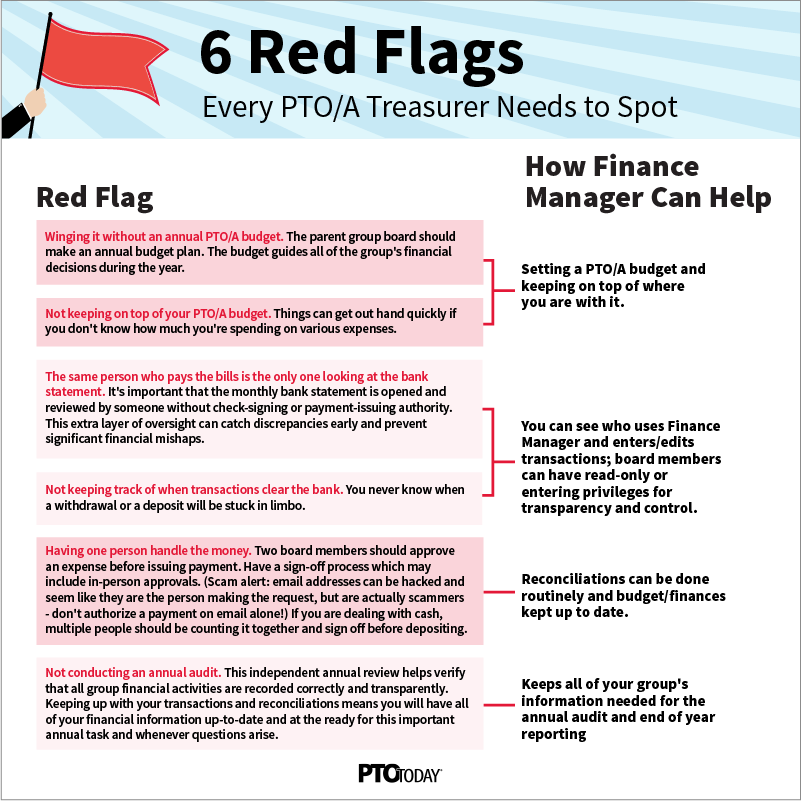

6 Red Flags Every PTO Treasurer Needs to Spot

Managing a PTO’s finances comes with more responsibility than many volunteers expect—but staying on top of key red flags can help avoid costly mistakes.

Whether you’re a new PTO treasurer or a seasoned pro, these six warning signs are worth watching for to keep your group’s funds secure (and your board out of hot water). Each red flag includes practical tips to help prevent fraud, ensure transparency, and maintain the financial health of your parent group.

🚫Winging it without an annual budget. The parent group board should make an annual budget plan (here's how to create a PTO budget). The budget guides all of the group's financial decisions during the year.

🚫Not keeping on top of your budget. Things can get out hand quickly if you don't know how much you're spending on various expenses.

🚫Having one person handle the money. Two board members should approve an expense before issuing payment. Have a sign-off process which may include in-person approvals. (Scam alert: email addresses can be hacked and seem like they are the person making the request, but are actually scammers - don't authorize a payment on email alone!) If you are dealing with cash, multiple people should be counting it together and sign off before depositing.

🚫The same person who pays the bills is the only one looking at the bank statement. It's important that the monthly bank statement is opened and reviewed by someone without check-signing or payment-issuing authority. This extra layer of oversight can catch discrepancies early and prevent significant financial mishaps.

🚫Not keeping track of when transactions clear the bank. You never know when a withdrawal or a deposit will be stuck in limbo.

🚫Not conducting an annual audit. This independent annual review helps verify that all group financial activities are recorded correctly and transparently. Keeping up with your transactions and reconciliations means you will have all of your financial information up-to-date and at the ready for this important annual task and whenever questions arise.

If your PTO, PTA or parent booster is looking for a way to handle budgeting, reporting and reconciliation, PTO Today's Finance Manager is a user-friendly tool designed exclusively for parent groups. Way more robust than Excel and less intimidating than QuickBooks, it offers all the functionality a PTO needs without the steep learning curve. And, at just $139 a year, it's super affordable for all parent groups (pardon the bad treasurer pun, but...that's a steal). Want to give it a try? Get a free 30 day trial (select "Software" in the PTO Today store).

PTO Today's Finance Manager can help you watch out for all the red flags above:

- Setting a budget and keeping on top of where you are with it

- You can see who uses FM and enters/edits transactions; board members can have FM read-only or entering privileges for transparency and control

- Reconciliations can be done routinely and budget/finances kept up to date

- Keeps all of your information needed for the annual audit and end of year reporting stored, organized, and easily accessible from anywhere

More resources and tips for PTO and PTA Treasurers:

- PTO Treasurer Annual Checklist: This no-fluff checklist breaks down everything PTO and PTA treasurers need to keep finances on track and stress levels low.

- Financial Best Practices for PTO and PTA Groups: A must-read for every PTO and PTA Treasurer! Run your PTO or PTA like a business with these financial best practices for school parent groups.

- How to Create a PTO Budget: The nuts and bolts of setting up a comprehensive budget for your PTO or PTA.

- PTO Treasurer Midyear Budget Review: A springtime budget analysis can help PTO and PTA treasurers make plans for any surplus funds.

- Rules for Keeping PTO and PTA Records: Guidelines for how long you should keep bank statements, meeting minutes, and more.

📲 Subscribe to our free weekly newsletter for your weekly dose of all things PTO