Managing Your Scrip Program

If you haven’t tried scrip yet, it can add an extra dimension to your fundraising. But it also requires some extra financial controls and a well-organized system to administer it.

Scrip fundraising is based on the resale of gift cards or gift certificates. The word scrip is defined in Webster as “a printed document that entitles the bearer to something of specific value.” In a scrip fundraising program, the PTO’s customers purchase gift cards at full face value, usually selecting from a long list of merchants. The parent group in turn purchases the ordered gift cards from a scrip broker at a discount.

Because of the volume of scrip purchased overall, the broker is able and willing to sell the gift cards to the PTO at a discount. The parent group keeps the difference between the money collected from its customers and the money the PTO pays to the scrip broker as profit. Each merchant has its own profit percentage, usually ranging from 2 percent to 13 percent or even more. Since the customers are getting full face value for their purchases and the PTO is earning profit, scrip can be a win-win fundraiser.

The full potential of scrip is realized when your parents get into the routine of purchasing cards on an ongoing basis for their own personal use. While your PTO might make a few hundred dollars offering a onetime scrip sale for holiday gift-giving, you can earn far more if you continue the program year-round.

Join the PTO Today community (it's free) for access to resources, giveaways and more

Many tuition-based schools use scrip to provide tuition reduction to their parents. These schools usually sell scrip on a weekly cycle, all year. In this case, some of the profit is applied directly to the student’s tuition balance, which thus generates huge participation and huge sales volumes. A portion of the profit typically goes to the school’s general fund, too.

Even if your school is tuition-free, scrip can generate a continuous income stream. Scrip might even be reason enough to finally file for 501(c)(3) status since some brokers sell only to federally registered nonprofits. (In most cases, however, your group only needs to demonstrate that it functions as a nonprofit.)

As rewarding as scrip can be, the program has unique characteristics that can send shivers down the spine of the conscientious PTO treasurer. However, by implementing a few financial controls, the rapid and continuous flow of money in a scrip program can be protected and monitored so the PTO treasurer can sleep soundly.

Paperless Transactions

One of the ways the scrip broker controls its costs so it can offer these discounts is to operate in a nearly paperless environment. Obviously, the gift cards and gift certificates are tangible, but the transactions to order scrip and to pay the scrip company generally are paperless. To ensure these electronic transactions are posted correctly, you and the scrip coordinator should rely on some good old-fashioned paper control forms. If you have a large scrip program, you should also have a separate bank account just for the scrip funds.

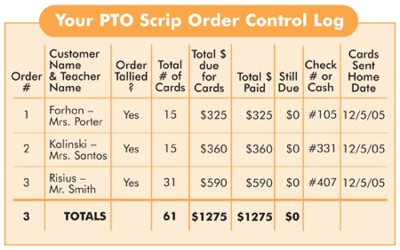

The first step in the scrip cycle is to collect orders and payments from your customers. If your scrip coordinator receives more than a few orders, it is helpful to begin by recording them on an order control log. This form is a simple ledger sheet that provides a convenient place to list the orders, money due, and money paid by each customer. Any discrepancies in money due will be highlighted here for follow-up by the scrip coordinator before the cards are ordered.

Since most scrip programs are ongoing, trying to figure out when to cut off orders can be confusing. For simplicity, the scrip coordinator should announce a specific due date for each batch of orders. Orders received by the due date will be processed together in one batch. For example, your PTO might announce that scrip orders are processed each Monday afternoon. Any orders received after Monday at 9 a.m. will be included in next week’s batch. When all the orders in the batch have been logged, the coordinator should total the money, prepare the deposit form, and pass the money and paperwork to the treasurer for deposit.

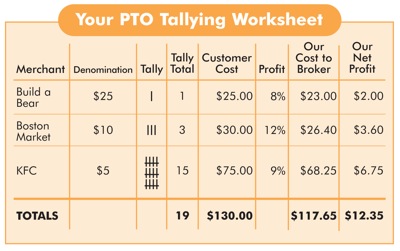

The next step for the coordinator is to tally the orders. With dozens of merchants to choose from, your customers will often order scrip from many different ones. To complete the online purchase, you must first consolidate all the cards ordered for each merchant. This process is best done on a tally form that the scrip coordinator can then use as her guide for placing the online order. The tally form is a spreadsheet that lists the name of the merchant and card denomination, plus number of cards ordered for each denomination. The tally form should also sum the total sales dollars for this batch of scrip cards.

As treasurer, you should expect the total sales number to match exactly the amount of money given to you by the scrip coordinator for this batch. To make this comparison, the scrip coordinator must give you a copy of the tally form, along with the cash and checks. Also, as you will read below, it is important to make the deposit quickly, so the money is available to pay the scrip broker. Verifying the deposit is your first point of financial oversight.

On the other end of the scrip cycle, the broker will deduct (debit) his payment directly from your PTO’s bank account. This electronic transaction happens automatically and quickly, allowing the broker to ship your scrip cards within a day or two of the online order. Quick turnaround is one of the benefits of a scrip program, especially if you run a weekly sale. However, the use of electronic debits demands close scrutiny from the treasurer. (Note: Most scrip brokers will accept a standard check as payment from a PTO, but delivery time is extended dramatically).

One of your primary responsibilities as PTO treasurer is to protect the group’s funds, whether that means making deposits quickly, securing the checkbook, or, in this case, ensuring that the electronic debit is accurate. The amount of money debited from your account is the discounted cost, leaving the PTO’s profit from the scrip sale still in your bank account. For example, if your customers order $800 in scrip, you will deposit $800 into your bank account. Assume the discount on all the scrip cards in this batch is 6 percent. So the scrip broker will debit 94 percent of the $800 in sales from your account. That leaves $48 in profit in your account, and the broker will have been paid $752.

<

Looking at the bank statement, you can readily identify a scrip debit against your account. But how do you know that the debit amount is exactly what was expected for this set of scrip orders? This is your second point of financial control. You should validate the debit amount.

When your scrip coordinator tallies the orders, she should also list the discount percentage offered by each merchant. In our simple example above, all the cards in the batch gave a 6 percent discount. However, in real life each merchant could offer a different discount percentage. The only way you can be certain of the expected debit amount is to know the exact percentages and number of cards ordered for each scrip batch. This information should be recorded on the tally form.

Each batch of cards to receive should include a packing order from the broker. The packing order should list each scrip certificate, the amount, the amount of the discount, and any additional charges, such as shipping. It’s extremely important to verify the packing order against what you actually receive. Do this before you distribute any of the certificates. If there’s a discrepancy, you’ll need the serial number from each card in the order to make a claim.

The scrip broker should also send an email to your coordinator confirming the order for each batch of cards. Ask your coordinator to forward the email to the treasurer, as well. With this email, the deposit form, the order control log, and the tally form, you have all the tools you need to validate the flow of money. You are not second-guessing your PTO’s scrip coordinator; you are overseeing the financial process.

Separation of Duties

To protect the integrity of the scrip program, you should divide the responsibilities between two co-coordinators. One coordinator should be in charge of collecting the orders from your customers, verifying the money paid, and tallying the orders. The other coordinator will actually place the order with the scrip broker. This way, only the cards actually paid for will be ordered from the scrip broker.

Consider this scenario where only one person is in charge of scrip: The scrip coordinator prepares this week’s consolidated order for the batch, then remembers that she wanted to buy a $50 card for Uncle Jim’s birthday. She won’t get paid until Thursday, but if she adds this card to today’s order, she’ll get the gift in time for Jim’s birthday party. She figures no one will notice, and she’ll just write the check next week after she gets paid—if she remembers.

The unique nature of a scrip program could allow sloppy habits to compound financial errors. In the worst case, poor management could even open the door to dishonesty. By separating the duties between two coordinators, your parent group protects both its resources and its volunteers.

Prepurchased Scrip

Some parent groups with substantial scrip experience have found it beneficial to keep certain gift cards on hand for cash-and-carry sales. These groups often set up a table in the school lobby where their loyal customers can turn in weekly scrip orders or purchase favorite cards on the spot. To provide cash-and-carry scrip, the group must purchase the popular cards using cash on hand in the PTO bank account. As customers purchase the on-hand cards, the treasurer should apply the money paid to the scrip budget on the PTO’s books.

In this case, your job is to ensure that prepurchased cards are always accounted for. Any cards on hand should be carefully inventoried. As cards are sold, the scrip coordinator should quickly turn in the money for deposit and record the reduction in on-hand inventory. Accountants can describe this situation with technical jargon. But if you just apply common-sense financial controls, you and the scrip coordinator can ensure that all prepurchased cards are accounted for, whether or not you are a CPA.

Family Profit Tracking

If your PTO ties scrip profits back to families for tuition reduction, you’ll need to track even more data. Specifically, you’ll need to post every scrip order back to the purchasing family, but the overall controls of “dollars in” and “dollars out” do not really change. Some PTOs successfully manage their tuition-reduction programs with a spreadsheet system like Excel. Others purchase a commercial software package written specifically to support scrip. Whichever approach you use, accurate record-keeping and timely reporting are essential.

Scrip adds an exciting new dimension to PTO fundraising. It also adds new responsibilities to your volunteers and to you as treasurer. However, once you establish the routine, the continual flow of scrip income will be both welcome and protected.

Should You Order Extra Cards?

Ordering extra scrip cards to sell on demand can increase your sales numbers. But should you do it? “People are surprised to learn that Great Lakes Scrip Company generally discourages this practice,” says Dave Burgess, the company’s vice president. Burgess offers several cautions.

Security

The scrip you keep on hand is just like cash. It needs to be stored under lock and key and handled like cash. A lockable file cabinet might be OK for a couple hundred dollars worth of scrip, but for anything else you need a safe, and you need to bolt the safe to the floor. And you have to be discreet. You don’t want the general public to know you typically keep several thousand dollars in the office safe.

Insurance

Does your carrier know what you’re storing on school property? Ask your agent about coverage.

Fraud

There are dishonest people everywhere. Sometimes people aren’t dishonest until they are tempted. Inventory is tempting.

Carelessness

Many costly errors happen not because of dishonesty but from carelessness. If your group sells scrip from a table at the school carnival, can you afford the loss when your well-meaning volunteer accidentally sells $100 cards for $25 each? What about the dozen certificates that fell behind the file cabinet? One or two mistakes can wipe out weeks or months of profit.

Inventory Aging

Most prepaid cards have liberal expiration dates or declining balances after a period of non-use. If you keep inventory on hand, make sure you have a “first in, first out” distribution policy so you don’t find yourself with inventory that will expire in a few months.

Guessing Wrong

If you decide to keep inventory on hand, you have to guess what people want. Guess wrong, and you could have your group’s valuable cash tied up while you’re trying to sell the extra cards.